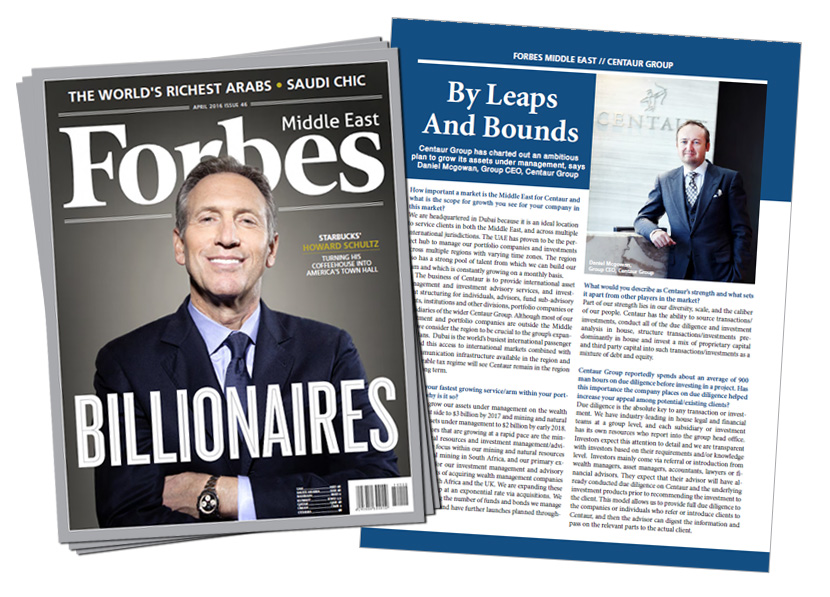

Centaur Group has charted out an ambitious plan to grow its assets under management, says Daniel Mcgowan, Group CEO, Centaur Group

How important a market is the Middle East for Centaur and what is the scope for growth you see for your company in this market?

We are headquartered in Dubai because it is an ideal location to service clients in both the Middle East, and across multiple international jurisdictions. The UAE has proven to be the perfect hub to manage our portfolio companies and investments across multiple regions with varying time zones. The region also has a strong pool of talent from which we can build our team and which is constantly growing on a monthly basis. The business of Centaur is to provide international asset management and investment advisory services, and investment structuring for individuals, advisors, fund sub-advisory clients, institutions and other divisions, portfolio companies or subsidiaries of the wider Centaur Group. Although most of our investment and portfolio companies are outside the Middle East, we consider the region to be crucial to the group’s expansion plans. Dubai is the world’s busiest international passenger hub and this access to international markets combined with the communication infrastructure available in the region and the favorable tax regime will see Centaur remain in the region for the long term.

Which is your fastest growing service/arm within your portfolio and why is it so?

We aim to grow our assets under management on the wealth management side to $3 billion by 2017 and mining and natural resources’ assets under management to $2 billion by early 2018. The two sectors that are growing at a rapid pace are the mining and natural resources and investment management/advisory. Our core focus within our mining and natural resources portfolio is coal mining in South Africa, and our primary expansion plans for our investment management and advisory portfolio consists of acquiring wealth management companies in the UAE, South Africa and the UK. We are expanding these parts of the group at an exponential rate via acquisitions. We are also expanding the number of funds and bonds we manage on our platforms and have further launches planned through-out 2016.

What would you describe as Centaur’s strength and what sets it apart from other players in the market?

Part of our strength lies in our diversity, scale, and the caliber of our people. Centaur has the ability to source transactions/investments, conduct all of the due diligence and investment analysis in house, structure transactions/investments predominantly in house and invest a mix of proprietary capital and third party capital into such transactions/investments as a mixture of debt and equity.

Centaur Group reportedly spends about an average of 900 man hours on due diligence before investing in a project. Has this importance the company places on due diligence helped increase your appeal among potential/existing clients?

Due diligence is the absolute key to any transaction or investment. We have industry-leading in house legal and financial teams at a group level, and each subsidiary or investment has its own resources who report into the group head office. Investors expect this attention to detail and we are transparent with investors based on their requirements and/or knowledge level. Investors mainly come via referral or introduction from wealth managers, asset managers, accountants, lawyers or financial advisors. They expect that their advisor will have already conducted due diligence on Centaur and the underlying investment products prior to recommending the investment to the client. This model allows us to provide full due diligence to the companies or individuals who refer or introduce clients to Centaur, and then the advisor can digest the information and pass on the relevant parts to the actual client.